Meet Sam Sukaton

A proven organizer, policy advocate, and problem-solver ready to make California’s tax system fairer for everyone

Sam Sukaton has built his life around one simple belief: when we play by the same rules, everyone can win. As a union organizer, policy leader, and former Jeopardy! contestant, Sam brings both street-level experience and big-picture thinking to every challenge he faces. Now he’s ready to bring that same combination of intellect, integrity, and practical problem-solving to the California State Board of Equalization.

Rooted in California values

Growing up in the Inland Empire, Sam learned early that fairness isn’t automatic — it’s something you fight for. The son of working-class parents, he grew up seeing neighbors work hard, pay their taxes, and still struggle to get ahead. That experience shaped his lifelong commitment to building a system that rewards honesty, protects working families, and ensures everyone contributes their fair share

At UCLA, Sam watched his classmates struggle with fee increases – and hasn’t stopped seeing students struggle with them since. UCLA taught him about Prop 13’s loopholes – which inadvertently starve our communities and state of funding for public services and makes every public workers’ contract, every student’s term, and every teacher’s new year a struggle. That’s why he’s running for the Board Of Equalization, the only elected state tax commission in the US – to put schools and communities first and reinvest our money for the many, not the few.

Decades of advocacy and financial know-how

Over the last fifteen years, Sam has worked at the intersection of public policy, legislative advocacy, and community organizing. He directed Senator Bernie Sanders’s 2020 campaign in Inland Southern California. He’s led climate budget investment and redistricting campaigns with California Environmental Voters. Most recently, as Lead Organizer for AFT Local 1521, the LA Community College Faculty Guild, he’s organizing students and representing faculty in the Los Angeles Community College District — the largest community college district in California

He’s worked before with the California Public Utilities Commission, Energy Commission, Air Resources Board, and Natural Resources Agency, gaining first-hand experience with how California’s investments in clean energy, climate resilience, and innovative land use move us all toward a sustainable and healthy future.

That experience has moved him to run for the Board of Equalization, which oversees California’s property-tax system and ensures revenues that fund schools, cities, and counties are collected and distributed fairly and spent on the infrastructure Californian’s need. From disaster relief to clean energy to basic school funding, Californians need – and deserve – more.

A record of results and readiness for office

Sam has consistently delivered results by bringing people together — from environmental advocates to labor leaders, from local governments to small-business owners. His work has helped advance clean-energy initiatives, protect homeowners, and secure fair funding for public education.

At the BOE, he will focus on:

Fair and uniform assessments – making sure homeowners and small businesses are treated equally across counties.

Transparency and modernization – upgrading systems so taxpayers can see where every dollar goes, as well as opportunities to raise new revenue with things like split-roll.

Fiscal responsibility – ensuring state and local revenues are managed efficiently and ethically.

Equitable growth – supporting policies that strengthen local economies while safeguarding the environment.

Bringing imagination integrity, and innovation to public service

Sam’s time on Jeopardy! may have been a moment in the spotlight, but it also symbolizes his approach to public service: preparation, curiosity, and fair competition. He believes that when government works with thee precision and accountability expected of its citizens, Californians benefit at every level — from homeowners and small-business owners to schools and local governments.

Sam Sukaton is ready to bring fairness, fiscal responsibility, and a lifelong love of learning to the State Board of Equalization. Because we know that in California, we all do better when we all do better.

Sam’s Plans for BOE:

Ensuring Tax Fairness & Uniform Assessments

Sam will ensure that taxes are administered fairly and uniformly across California. The BOE’s mission is to “serve Californians through fair, effective and efficient tax administration in support of state and local governments.

He will:

Strengthen oversight of county assessors so that property valuations and exemptions are applied consistently.

Promote transparency in how assessments, appeals, and exemptions work so taxpayers understand their rights and responsibilities.

Fight for small businesses and homeowners to be treated equitably — no hidden fees; no unfair advantages, and direct access to the tax system.

Modernizing the System for Efficiency & Accountability

Sam will push to modernize the Board’s processes so that tax administration is more efficient, more accountable, and more accessible for all Californians. The BOE’s strategic plan emphasizes revitalizing and modernizing to deliver “gold-standard services.”

He will:

Expand awareness of online tools and data-portals so taxpayers can track assessments, appeals, and exemptions easily – from tax prep clinics to budget season dashboards, Sam wants to make it easier for you to invest in California and see results.

Maintain rigorous audits and compliance checks of assessors to ensure local performance meets statewide standards.

Foster a culture of accountability within the Board — timely public reports, clear performance metrics, and responsiveness to taxpayer concerns.

Protecting Local Schools, Cities & Counties

Sam recognizes that the property-tax system — administered in large part through the BOE’s oversight — is the backbone of funding for schools and local governments. For example: in fiscal year 2023-24, the statewide assessed value was $8.6 trillion, resulting in $95.3 billion of property tax levies.

He will:

Ensure that local governments get their fair share of revenues from tax programs — no unfair allocations or delays.

Support exemptions and relief programs for veterans, seniors, and low-income homeowners — while ensuring the tax base remains strong and equitable.

Collaborate with local officials to streamline appeals and assessment processes, reducing taxpayer confusion and administrative burden, and work on fixes to support our state’s needs for revenue, housing investment, and accountability for insurers.

Fairness for Working Families & Small Businesses

Sam’s progressive values combined with pragmatic solutions mean he will fight for fairness in the tax system — especially for working families and small businesses. The BOE, via its Taxpayers’ Rights Advocate Office, already has a role educating taxpayers about exemptions and rights.

He will:

Expand outreach so underserved communities (renters, small business owners, first-time homeowners) know about tax credits, exemptions, and appeal rights.

Advocate for tax policy that supports local job growth and investment — ensuring that tax burdens don’t stifle enterprise, and that revenues support the infrastructure businesses rely on.

Promote a transparent appeals process so taxpayers feel confident the system is working for them, not against them.

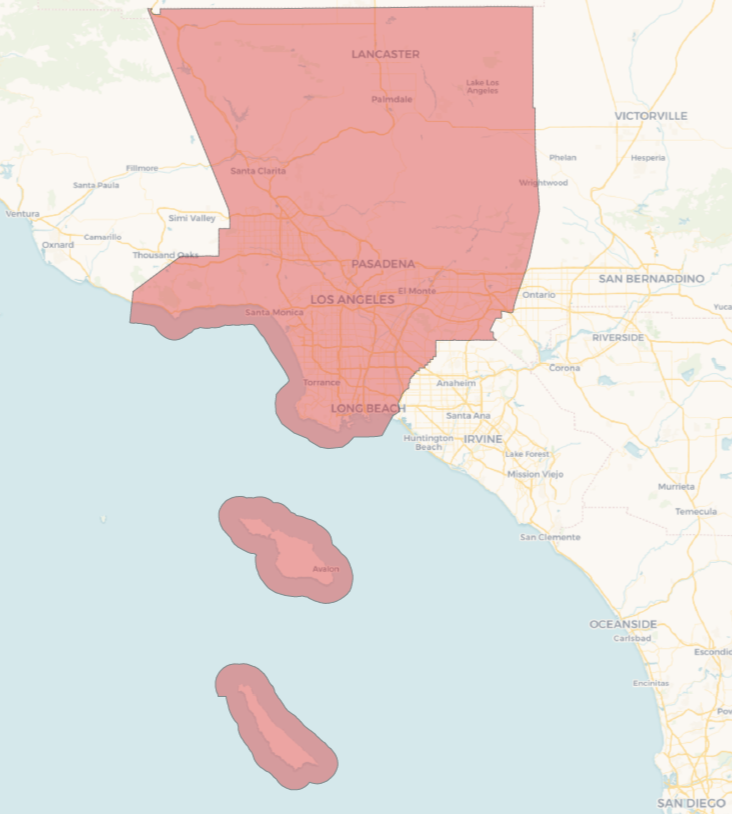

Board of Equalization District 3

Follow us on socials:

Contact

Interested in working together? Fill out some info and we will be in touch shortly. We can’t wait to hear from you!